Another issue individuals contemplating divorce must resolve is who gets to claim the Dependency Exemptions for the children. In general, a taxpayer may claim a Dependency Exemption for each child who is under age 19, or under age 24 if a full-time student, and lived with the taxpayer for more than ½ of the year, except for temporary absences including time away at school. The child must not provide more than ½ of their own support, excluding scholarships received. In the case of divorced or legally separated parents the exemption will go to the parent who has primary custody as determined by the number of nights in the parent’s home. If the custodial time is equal for both parents, the exemption (and the title of custodial parent) goes to the parent with the higher adjusted gross income. The Dependency Exemption in these situations may be waived by the custodial parent and transferred to the non-custodial parent by signing a Form 8332 which the non-custodial parent must attach to their income tax return.

Note that the ability of the taxpayer to claim Head of Household filing status stays with the custodial parent whether or not they may have waived the Dependency Exemption. The child tax credit on the other hand may only be claimed by the parent that actually claims the Dependency Exemption.

The experts in our tax department have navigated this sensitive area of the IRS tax code many times and are more than equipped to assist you in your tax preparation.

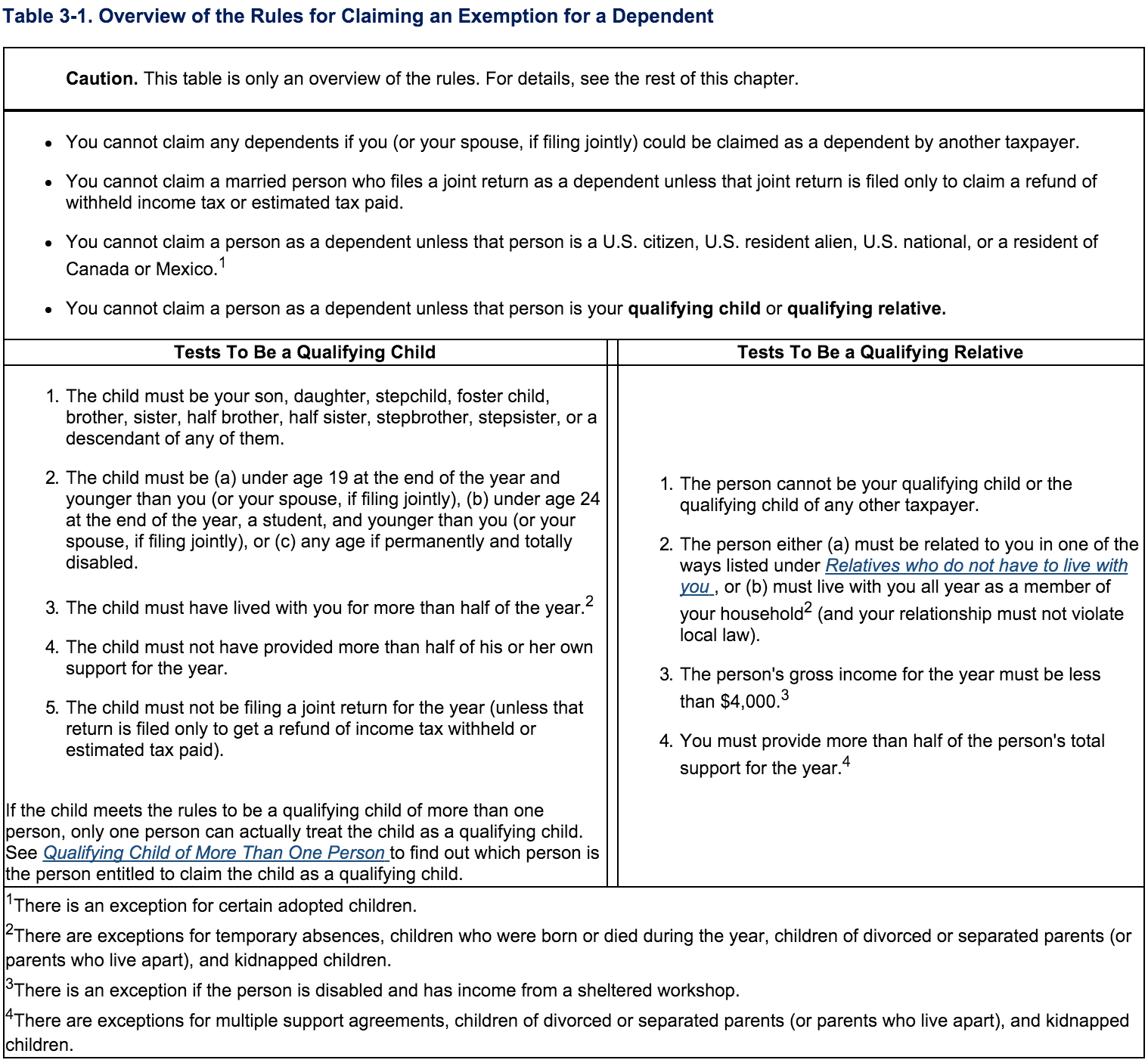

The following table taken from IRS Publication 17, Chapter 3 provides more detailed information on this tricky subject.

Here’s a brain teaser: If Mother has pmairry physical custody of her 2 children in 2009 and it’s noted in a decree that she receives the tax exemption for both children, and in 2011 a modification occurs in which child A is 50/50 and child B lives primarily with father, who gets to claim the tax exemption for the children?According the the IRS dad would get to claim Child B and since there are 365 days in a year, Mom and Dad would switch off the tax exemption for child A.In actual practice, if Dad claims both children Mother could hold him in contempt because the modification only changed physical custody, not who gets to claim the child for child tax credit.

Yes, I believe you have a point there. The IRS allows a fair amount of flexibility with respect to which of two divorced parent may claim the dependent exemption with the caveat that if the parent with less than 50% physical custody is to claim the exemption, they should have the more than 50% custodial parent sign an IRS Form 8332 Release. Therefore, divorce agreements commonly do award exemptions without regard to physical custody. Moreover, in the scenario you lay out the husband may in fact be in default of the terms of the agreement.

How about if the father has already committed 1,000pesos in a week but an accident happened to him making him not to fullfil the signed agreement and he can only give 500pesos per week.. Is it possible then that he got in prison because he fail to give the signed agreement?

What are the considerations or excemption regarding in supporting a child? How about if the father is not professional and have no work, did the complainant can still demand a higher support?